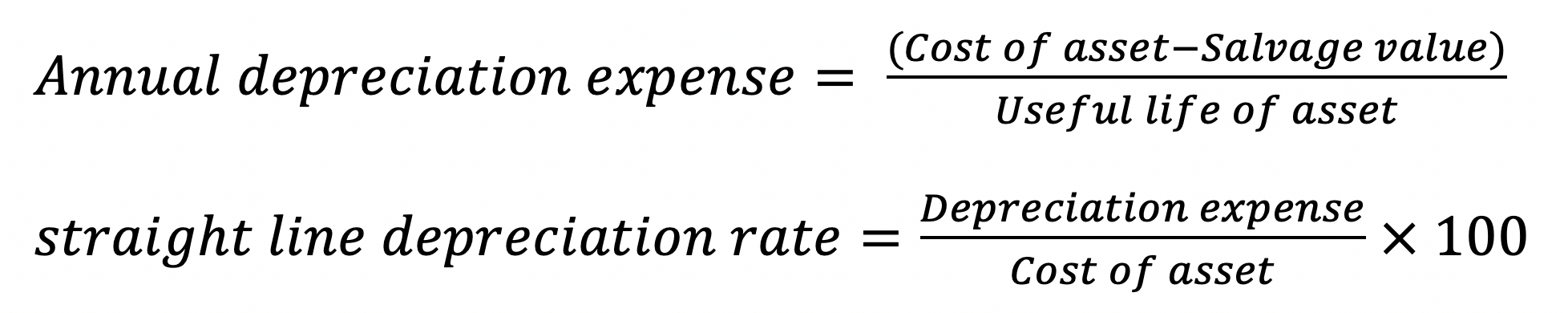

Yearly depreciation formula

Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. Calculating Depreciation Using the Units of Production Method.

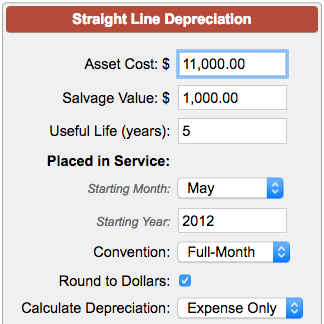

Depreciation Expense Calculator Best Sale 57 Off Www Ingeniovirtual Com

Returning to the PPE net line item the formula is the prior years PPE balance less CapEx and less depreciation.

. In straight-line depreciation the expense amount is the same every year over the useful life of the asset. So in the second year your monthly depreciation falls to 30. Non-ACRS Rules Introduces Basic Concepts of Depreciation.

Year four will be 25587 x 34 8700 and NBV 16887. Total yearly accumulated depreciation Asset cost - Expected salvage value Expected years of use 750 - 150 Expected years of use. It takes the straight line declining balance or sum of the year digits method.

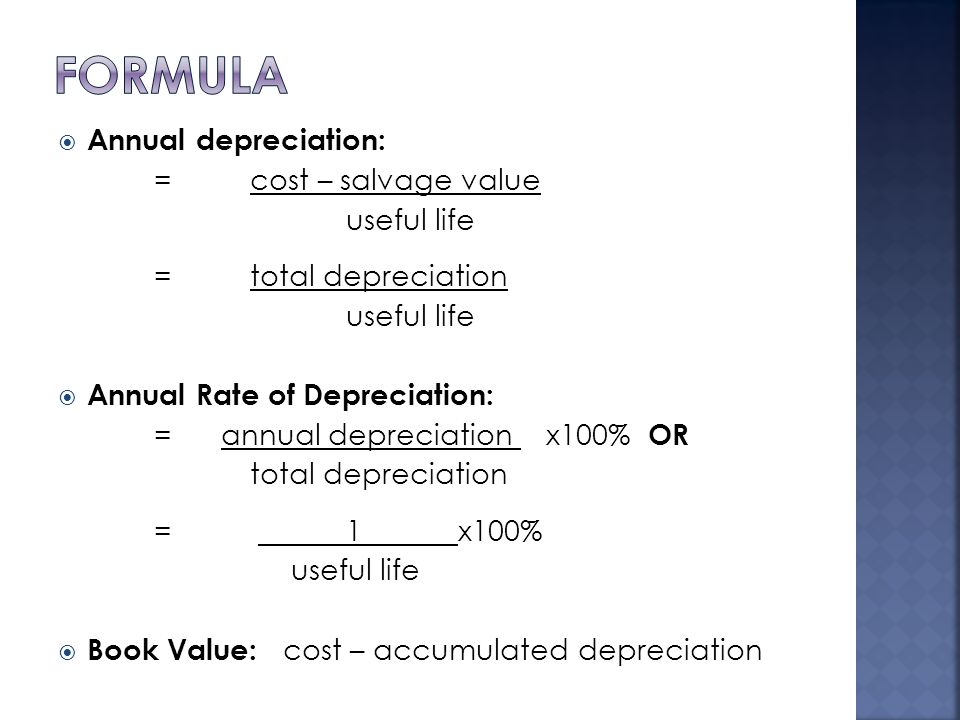

Annual Depreciation rate Cost of Asset Net Scrap Value Useful Life. Very often businesses will use a set diminishing depreciation rate for each group of assets for. Year five will be 16887 x 34 5743 and NBV 11145.

The depreciation amount changes from year to year using either of these methods so it more complicated to calculate than the straight-line method. Annual depreciation is the standard yearly rate at which depreciation is charged to a fixed asset. The four main depreciation methods mentioned above are explained in detail below.

Year seven will be 7356 x 34 2501 and NBV 4855. The following calculator is for depreciation calculation in accounting. You can calculate subsequent years in the same way with the condition that the.

If you are using the double declining balance method just select declining balance and set the depreciation factor to be 2. For example an asset with a 10000 basis and a useful life of five years would depreciate at a rate of 2000 per year. Straight-line depreciation is a very common and the simplest method of calculating depreciation expense.

For the double-declining balance method the following formula is used to calculate each years depreciation amount. It can also calculate partial-year depreciation with any accounting. Divide the difference by years of use.

The result of annual depreciation is that the reported. Asset cost - salvage valueestimated units over assets life x actual units made. This rate is consistent from year to year if the straight-line method is used.

For example the total depreciation for 2023 is comprised of the 60k of depreciation from Year 1 61k of depreciation from Year 2 and then 62k of depreciation from Year 3 which comes out to 184k in total. Simply divide the assets basis by its useful life to find the annual depreciation. To convert this from annual to monthly depreciation divide this result by 12.

The years of use in the accumulated depreciation formula represent the total expected lifespan of an asset. Year six will be 11145 x 34 3789 and NBV 7356. There are various methods to calculate depreciation one of the most commonly used methods is the straight-line method keeping this method in mind the above formula to calculate depreciation rate annual has been derived.

If an accelerated method is used then annual depreciation will spike early and then decline in later years. Straight-line depreciation is the easiest method to calculate. 25000 - 50050000.

Second year depreciation 2 x 15 x 900 360.

Depreciation Calculator Store 60 Off Www Wtashows Com

Straight Line Depreciation Formula And Calculation Excel Template

وحش انتقال تمطر راكب اقتراح ألباني How To Calculate Annual Depreciation Crossfit Bold Com

Accumulated Depreciation Definition Formula Calculation

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Method Of Depreciation Accounting Corner

Depreciation Rate Formula Examples How To Calculate

Depreciation Calculation

Exercise 6 5 Compound Depreciation Year 10 Mathematics

Depreciation Rate Formula Examples How To Calculate

What Is Accumulated Depreciation How It Works And Why You Need It

Depreciation Rate Calculator Sale Online 54 Off Www Ingeniovirtual Com

Equation Of A Straight Line Calculator Hotsell 51 Off Www Quadrantkindercentra Nl

Declining Balance Depreciation Double Entry Bookkeeping

Depreciation Expense Calculator Best Sale 57 Off Www Ingeniovirtual Com

Depreciation Rate Calculator Sale Online 54 Off Www Ingeniovirtual Com

Gt10103 Business Mathematics Ppt Download